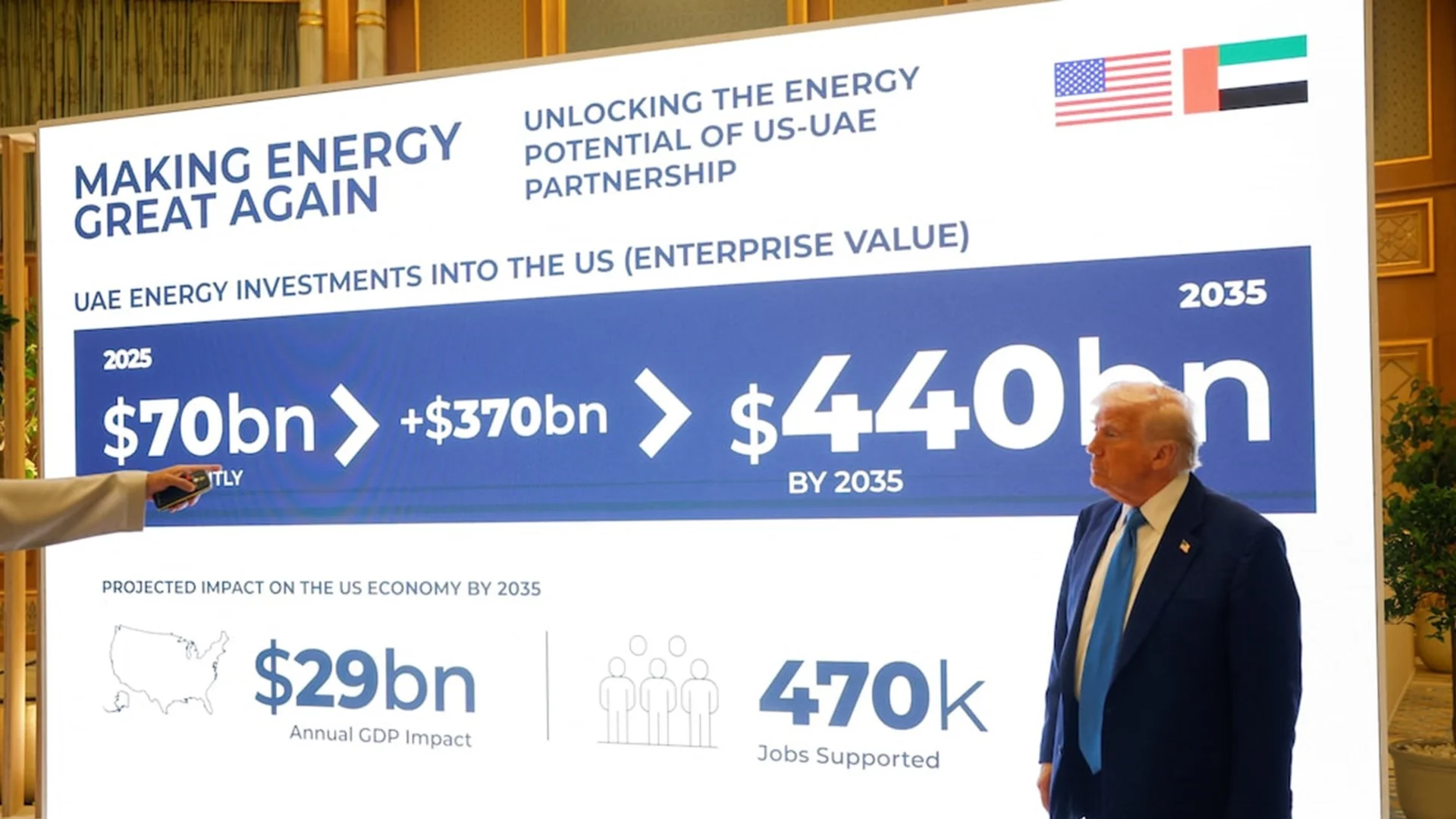

The announcement came in a presentation by ADNOC CEO Sultan Al Jaber, who told President Trump, “The enterprise value of UAE investments in the U.S. energy sector will rise to $440 billion by 2035 from $70 billion now.” The plan underscores the UAE’s ambition to diversify its portfolio while strengthening its position as a reliable partner in global energy security.

Al Jaber also highlighted reciprocal commitments from U.S. firms, stating, ‘Our partners will invest $60 billion in upstream oil and gas, as well as in new and unconventional opportunities.’ ADNOC stated that these investments will support multiple projects throughout their lifetimes, reinforcing stability and resilience in the energy markets.

Leading players have already signed agreements. ExxonMobil and Japan’s Inpex will expand capacity at Abu Dhabi’s Upper Zakum offshore field, while Occidental Petroleum will explore boosting production at the Shah gas field. EOG Resources has also secured an oil exploration concession in Abu Dhabi’s Al Dhafra region. ADNOC said, “The agreements reinforce the shared commitment of the UAE and U.S. to maintaining global energy security and the stability of energy markets.”

The UAE pledged a broader $1.4 trillion plan to Washington, including $440 billion in investments targeting AI infrastructure, semiconductors, energy, and manufacturing. The White House emphasized that this plan will “substantially increase the UAE’s existing investments in the U.S. economy.”

Artificial intelligence emerged as a key dimension of the partnership. The two countries signed an agreement enabling the UAE to access some of the most advanced U.S. AI semiconductors—a move seen as pivotal in Abu Dhabi’s efforts to become a global hub for artificial intelligence. Al Jaber noted, “We see significant opportunities for further UAE-U.S. partnerships across the energy-AI nexus, and we look forward to working with our American partners.”

President Trump also praised the scale of investment, saying, “We’re making great progress for the $1.4 trillion that UAE has announced it intends to spend in the United States.” He added, “Yesterday the two countries also agreed to create a path for UAE to buy some of the world’s most advanced AI semiconductors from American companies, a very big contract.” The president stressed that while traditional oil and gas remain vital, “you’re going to have equally big, and maybe even bigger—at some point, you’ll be surpassing it with AI and other businesses.”

ADNOC’s international investment arm, XRG, will play a central role in deploying the funds. XRG recently signed a framework deal with Occidental subsidiary 1PointFive to evaluate participation in a direct air capture project in Texas and has already taken over ADNOC’s stakes in NextDecade’s Rio Grande LNG facility and a planned ExxonMobil hydrogen plant. ADNOC said, “The U.S. is a top priority market for XRG,” with plans to boost investments across the American energy value chain, including gas, LNG, specialty chemicals, and energy infrastructure.

In addition, Mubadala Energy, part of Abu Dhabi’s second-largest sovereign wealth fund, signed a deal with U.S. firm Kimmeridge to acquire stakes in American gas assets, further expanding the UAE’s footprint in the U.S. energy market.

This wave of investments illustrates the UAE’s determination to drive long-term energy transition strategies while leveraging artificial intelligence, advanced manufacturing, and sustainable infrastructure. It also underscores Abu Dhabi’s role as a bridge between traditional energy partnerships and emerging technology frontiers.

Against this backdrop, platforms like the Electric Vehicle Innovation Summit (EVIS) and EcoMobility Global (EMG) taking place on 13–14 October 2026 at ADNEC, Abu Dhabi take on added importance. EVIS and EMG bring together global leaders in clean transport, sustainable mobility, and next-generation energy, turning transformative investments into real-world partnerships that accelerate a cleaner, smarter, and more sustainable future.